We review Xpatulator’s 2026 global cost of living rankings for international professionals, led by Monaco, Hong Kong, Singapore, Zurich, and several high cost United States and European cities, with New York City used as the benchmark. It explains why housing constraints, high service costs, import dependence, and currency strength drive the top tier, and it links year on year shifts to exchange rate movements, inflation dynamics, and selected current affairs that influence insurance and logistics. It concludes by recommending that expatriates compare purchasing power rather than headline salary, using tools such as Xpatulator’s Salary Purchasing Power Parity Calculator.

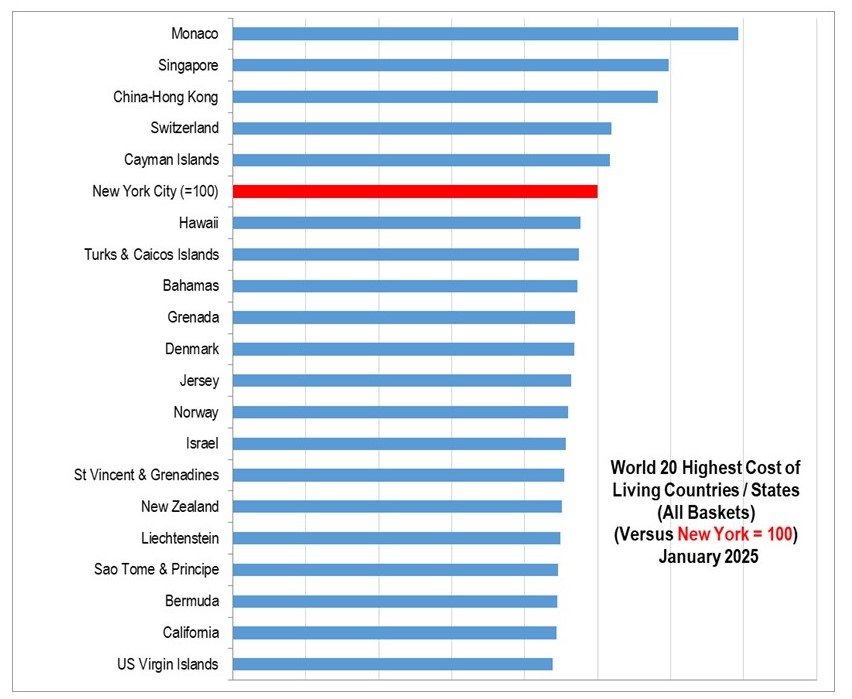

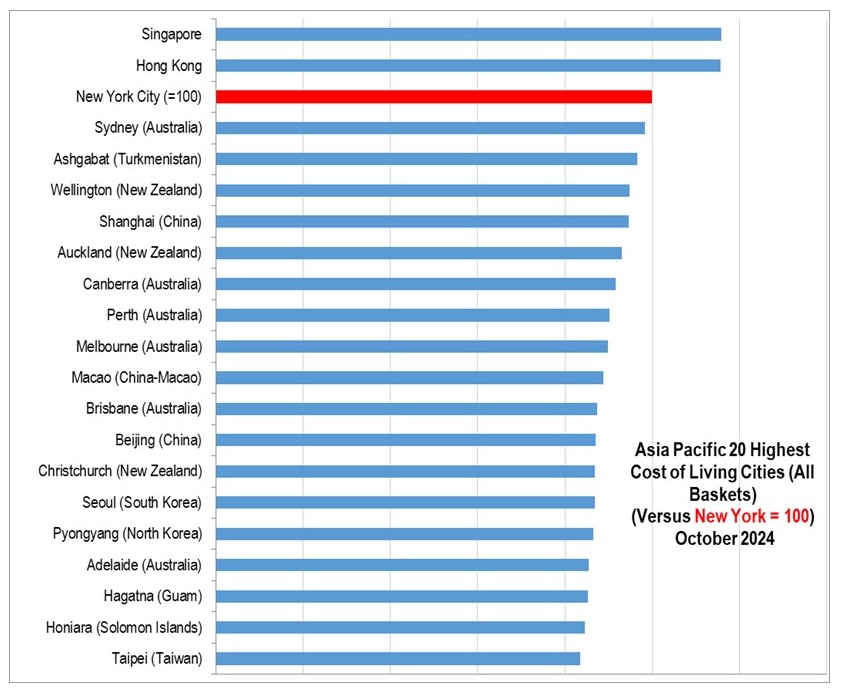

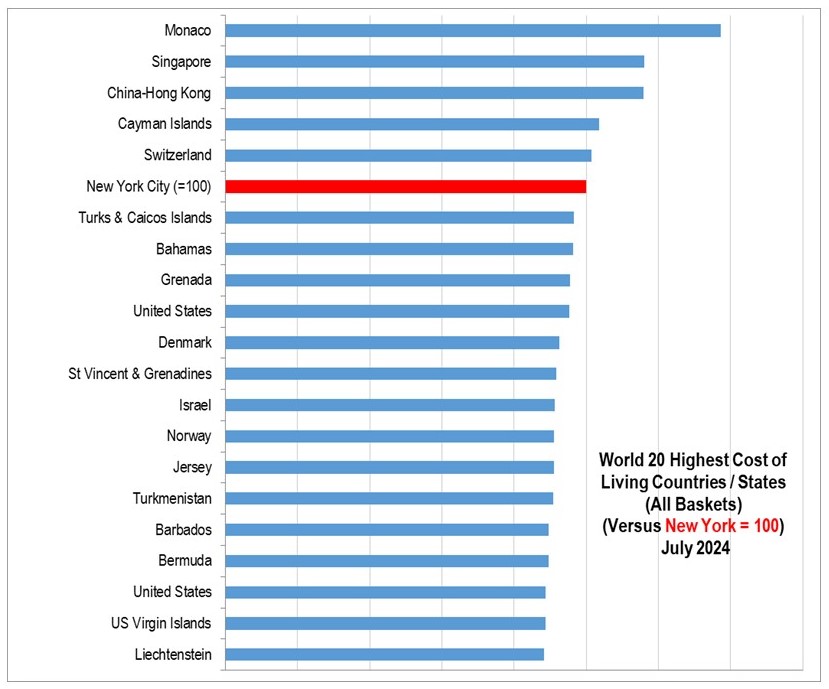

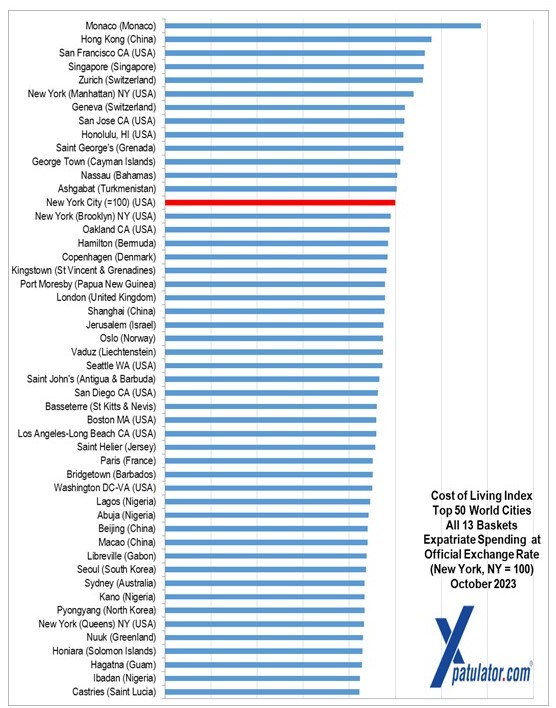

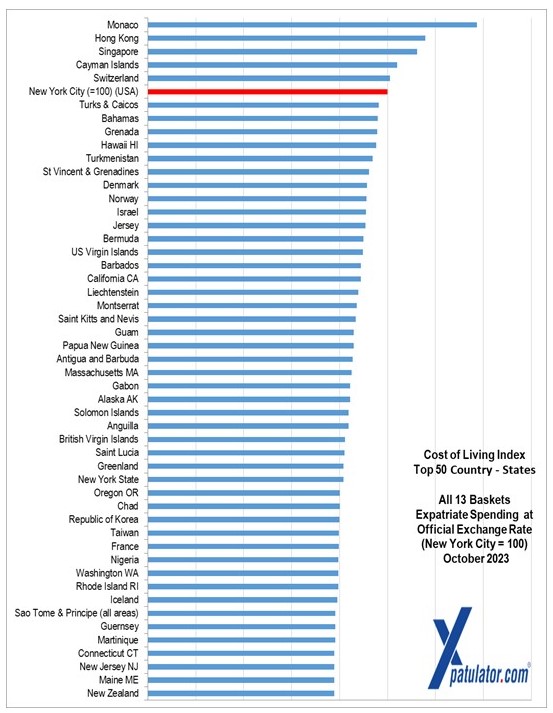

Xpatulator’s 2026 international city rankings highlight a simple pattern. The most expensive locations for international professionals tend to be compact, high income markets with constrained housing supply, expensive services, and currencies that hold value in United States dollar terms. New York City is set to 100 as a reference point. The top twenty then spans Western Europe, parts of Asia, and coastal United States markets, with a smaller set of high cost island hubs.

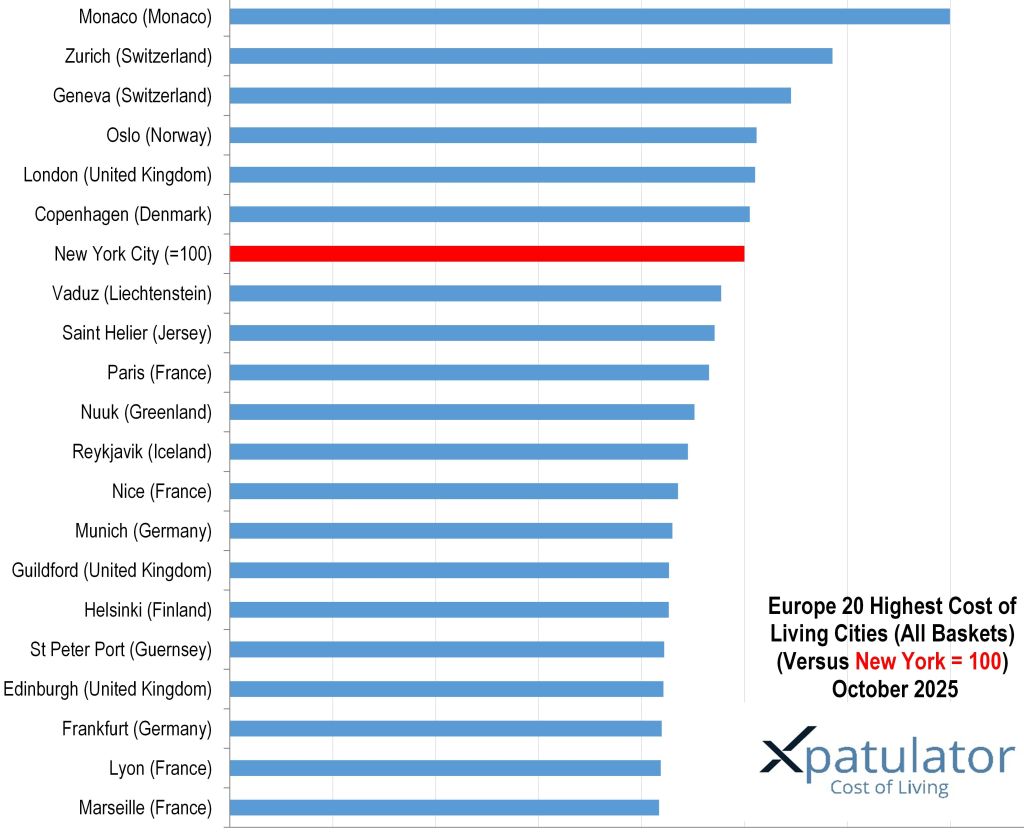

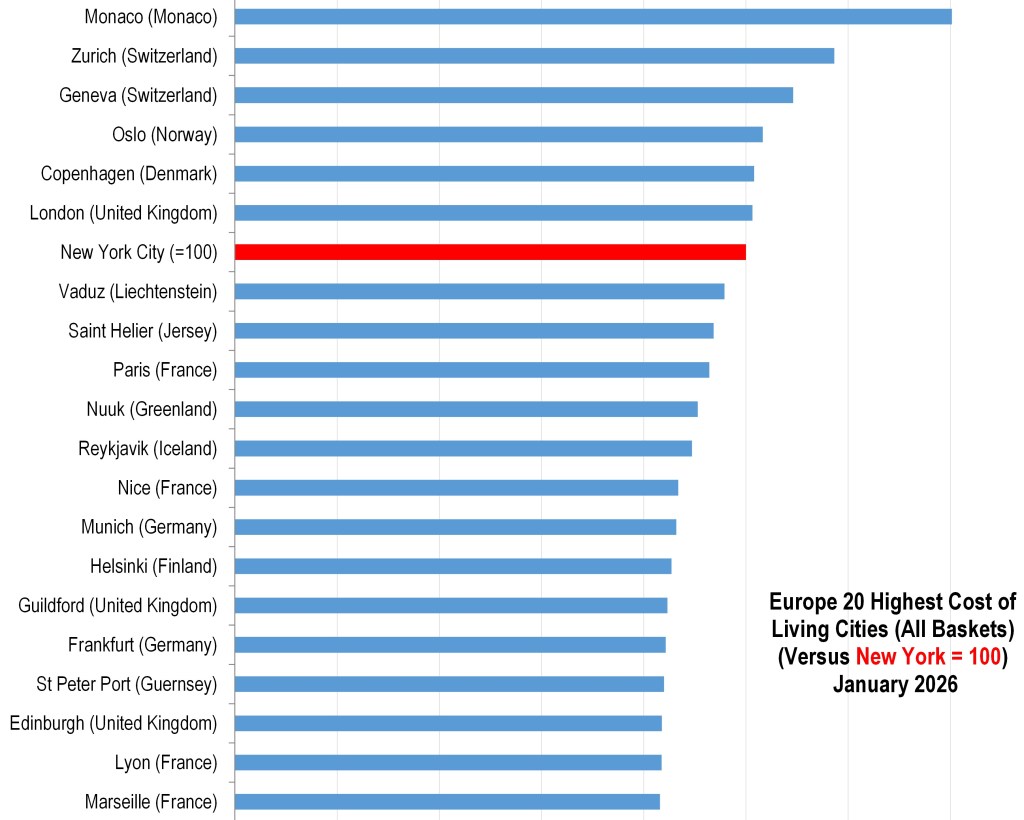

Monaco leads at 140.3 because residential supply is structurally limited and demand is persistently global. Housing costs typically dominate expatriate budgets, with private services following, because staffing and space are priced at a premium. Switzerland follows with Zurich at 117.3 and Geneva at 109.2, where high wages and high service costs translate into elevated everyday pricing for the consumption baskets typical of internationally mobile households. The Swiss inflation backdrop has been relatively subdued, with the Swiss National Bank signalling inflation remains within its target range, yet the Swiss franc’s safe haven characteristics often keep United States dollar converted costs high.

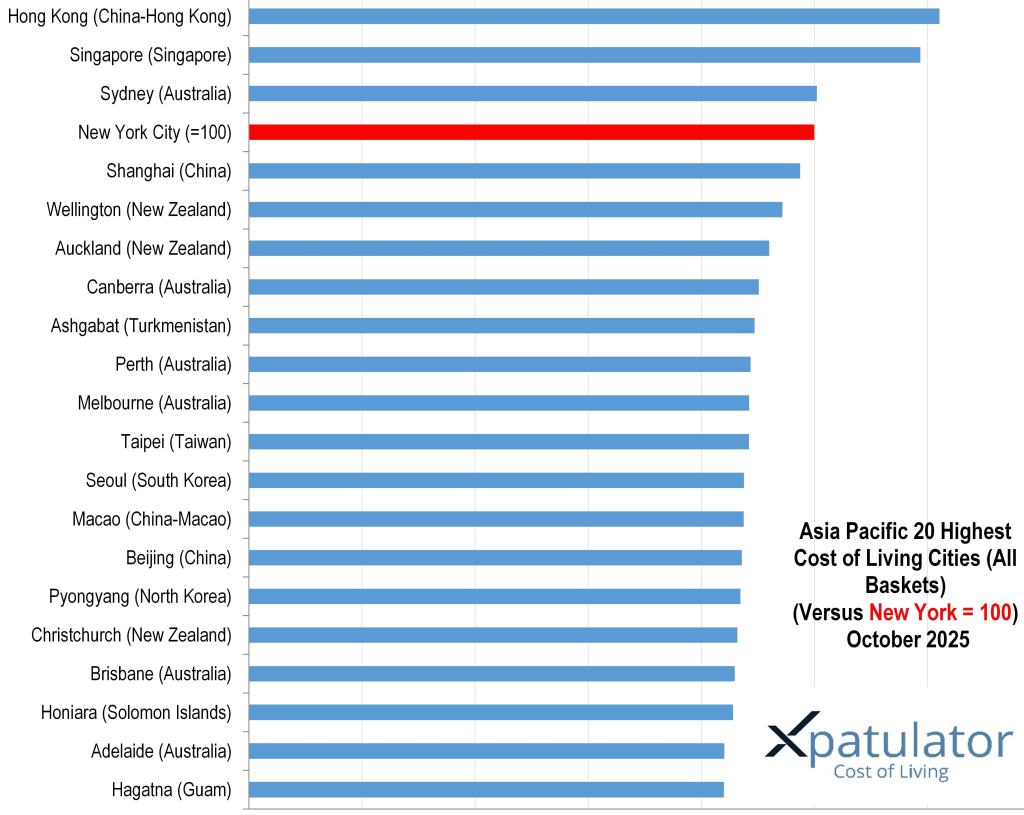

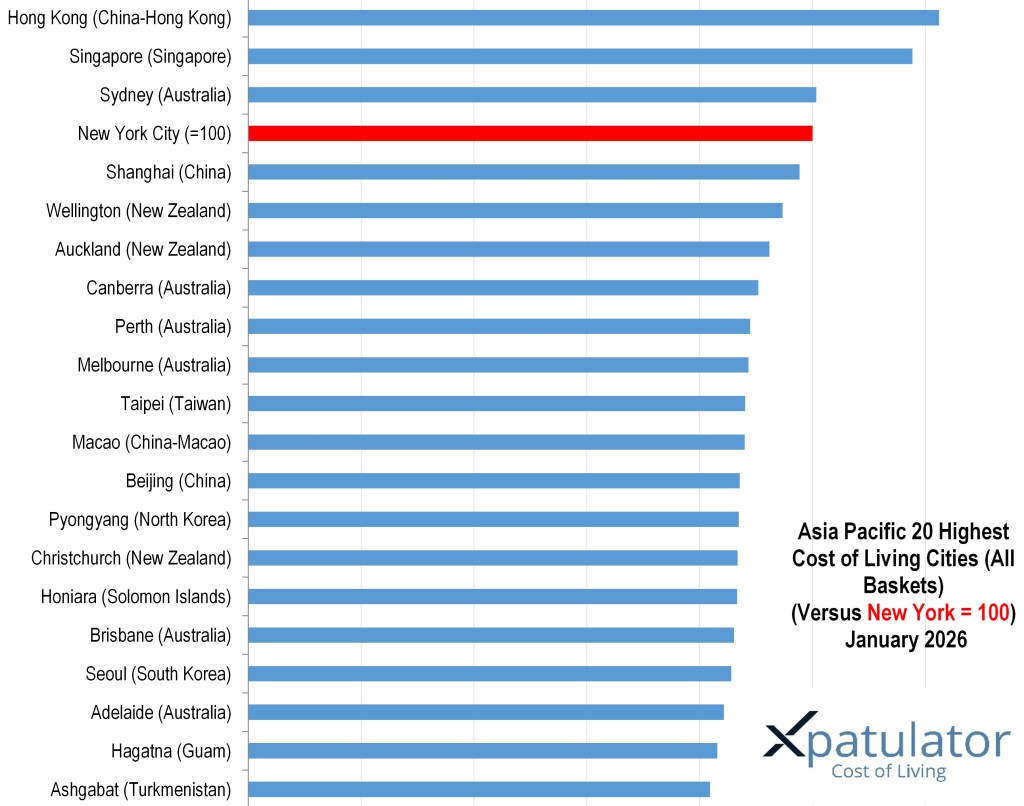

Hong Kong at 122.4 remains a housing driven story. The currency link to the United States dollar keeps the Hong Kong dollar within a defined band, so the ranking is shaped more by rents and premium services than by currency swings. Singapore at 117.7 combines expensive housing with high pricing for regulated or capacity constrained categories, including private transport where the certificate of entitlement system adds a significant cost layer for car ownership.

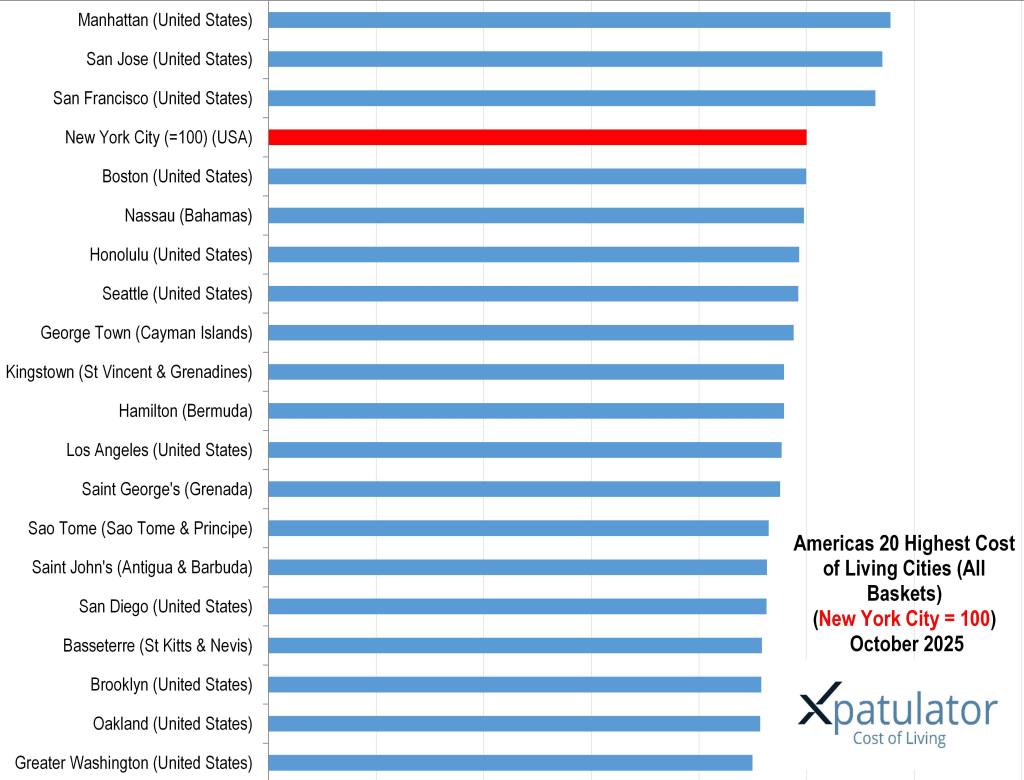

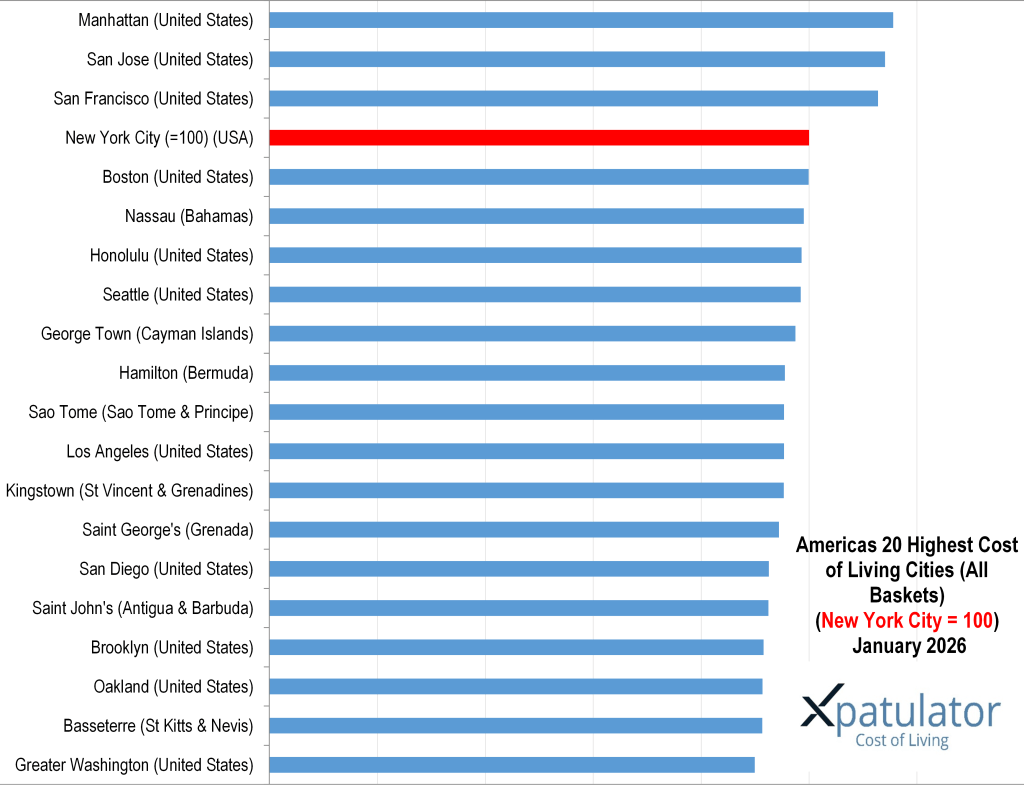

The United States cluster is led by Manhattan at 115.6, San Jose at 114.1, and San Francisco at 112.8, which is consistent with high housing costs in prime neighbourhoods and strong demand driven by high earning sectors. Recent market reporting continues to show elevated Manhattan rents on a year on year basis. Boston at 99.9 and Seattle at 98.4 sit close to New York City, reflecting expensive housing markets and high costs for labour intensive services. Honolulu at 98.6 adds an import and logistics premium that often pushes grocery and household costs higher than mainland United States cities, even when wages are lower.

Northern Europe sits just above New York City, with Oslo at 103.3 and Copenhagen at 101.6. These markets are affluent, and expatriates often feel the cost most in paid services, dining, childcare, and transport rather than in basic staples. London at 101.3 remains expensive through housing and private services, while still offering more trade offs between commute, space, and neighbourhood than smaller premium markets.

Sydney at 100.7 illustrates how a global lifestyle city can sit close to New York City once housing is priced realistically. Shanghai at 97.7 sits below New York City, but remains costly for expatriates who select higher specification accommodation and international schooling, and who rely on imported foods and premium services.

The high cost islands in this top twenty demonstrate a different mechanism. Nassau in the Bahamas at 99.0 and George Town in the Cayman Islands at 97.5 combine limited housing stock with import dependence and a smaller retail base, which can lift prices for many everyday items. These locations also tend to price services for an international client base.

Exchange rates can shift rankings meaningfully in a single year. The euro strengthened versus the United States dollar over the last year, which can raise United States dollar converted costs for euro area cities even when local inflation is moderating. The European Central Bank reference rate shows the euro at around 1.17 United States dollars in late January 2026 and explicitly reports the change over the prior year. Hong Kong’s currency band reduces exchange rate volatility in United States dollar terms. Several Gulf currencies are also pegged, which is one reason their cost comparisons often move more with local rents and inflation than with foreign exchange.

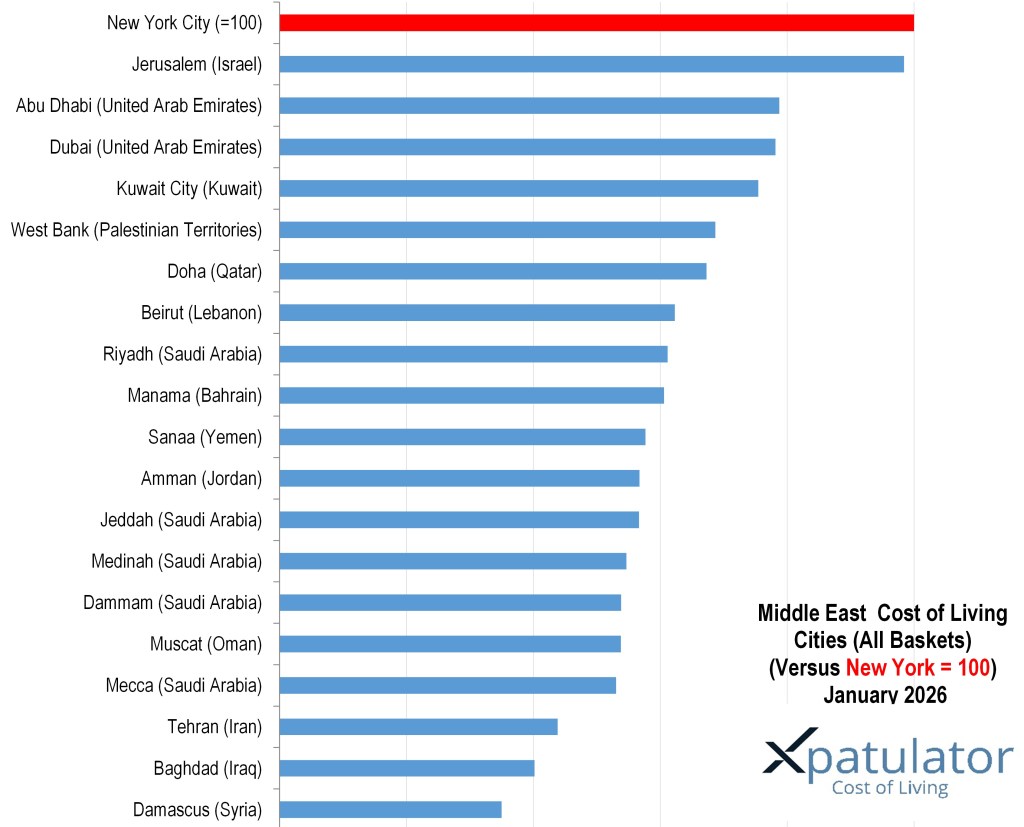

Current affairs and security conditions can also influence expatriate costs, particularly through insurance, security, and logistics. Jerusalem at 98.4 is the highest ranked city in the Middle East list, and it sits close to New York City in the global benchmark, while operating in a region affected by ongoing conflict and periodic instability. The Israeli shekel has also strengthened, which can raise United States dollar converted living costs for expatriates paid in dollars. More broadly, shipping disruption and higher war risk insurance can feed into import costs across multiple regions, which is especially relevant for island markets and smaller import dependent economies.

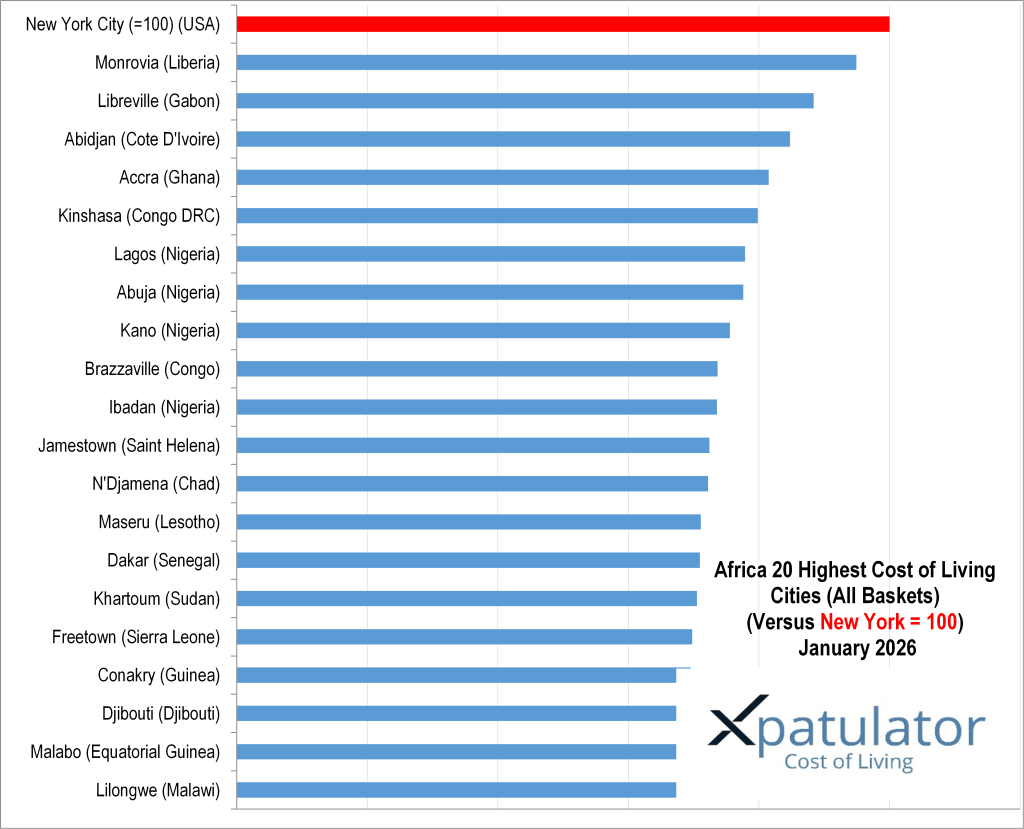

Africa city rankings highlight a recurring expatriate pattern: living costs can sit uncomfortably high even where local incomes are low. The main driver is not day to day local consumption, but the “international professional” basket that concentrates spending into a narrow set of scarce, higher specification goods and services: secure housing, reliable power, private healthcare, international schooling, imported food, and private transport.

Inflation trends provide the final layer. Xpatulator’s international inflation rates page is designed to help users connect country inflation dynamics to cost of living outcomes. Even when headline inflation eases, the categories that matter most to expatriates, especially housing, schooling, healthcare, and paid services, can remain sticky.

For expatriates, the practical implication is that headline salary rarely tells the full story. A move from a lower cost city to Monaco, Zurich, Hong Kong, Singapore, or Manhattan can materially reduce salary purchasing power unless the package recognises the host city’s housing and service costs. Studying cost of living differences in advance helps quantify the likely post rent and post schooling income that funds savings and discretionary life. Skipping that step often leads to avoidable trade downs in accommodation, longer commutes, or unplanned use of savings. Xpatulator’s Salary Purchasing Power Parity Calculator supports this analysis by converting pay into comparable purchasing power and modelling the baskets that international professionals actually fund from salary.

Use Xpatulator’s Cost of Living Calculators and Tools for informed decision making about the cost of living and the salary, allowance, or assignment package required to maintain the current standard of living.